MacroInsight / Click here for full PDF version

Author(s): Luthfi Ridho ;Samantha Junita

- BI decided to increase the BI rate by 25bp to 6.25% as a forward-looking policy aimed at protecting Rupiah from rising global uncertainty.

- BI change its FFR baseline scenario to one time increase in FY24 and give guidance on Rupiah to be at Rp15.8k/US$ in the 4Q24.

- We see BI rate increase to be imperative to promote Rupiah stability and expect another 25bp increase in the near-term.

25bp BI rate hike aimed to maintain Rupiah stability

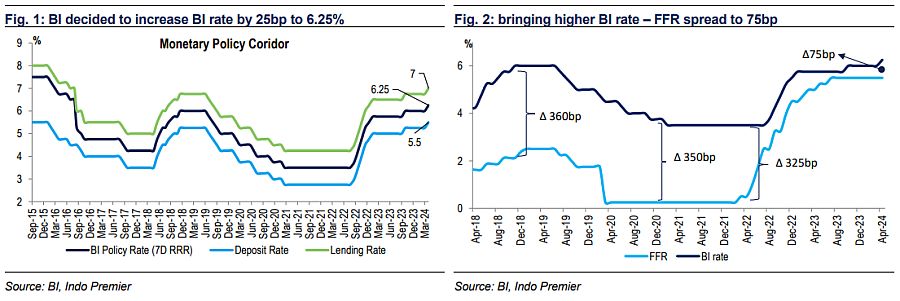

BI decided to increase the BI rate by 25bp to 6.25% along with deposit/lending facility to 5.5/7.0% aimed to maintain Rupiah stability. In parallel, the higher interest rate was also to mitigate imported inflation risk from escalating geopolitical tension. Furthermore, it guided that inflation will be on its target range at c.2.5%1% corridor in FY24, as harvest season normalization will bring food prices down. Lastly, it kept the economic growth projection at c.4.7-5.5% in FY24. Indicating the economy's resiliency from higher interest rate costs.

FFR expectation revised to be a 25bp cut instead of 75bp

On the FFR expectation, it revised to just one time cut at 25bp in Dec24 as their baseline scenario (previously the FFR cut expectation is at c.75bp in 2H24). On the alternative scenario, it expects no FFR cut in FY24 but 25-50bp FFR cut in FY25.

Expect another 25bp increase to further guard the exchange rate; revising our exchange rate assumption to Rp15.8/US$ from Rp15.1/US$

We see the increase in the policy rate to be imperative and we think another 25bp increase is possible within the year to maintain the currency stability. This is due to the external pressure that made the use of FX reserves to be ineffective (total US$6bn of reserves has been depleted as of Mar24) to guard the Rupiah volatility (tripled since end of Mar24 at around 4.0 index point to around 13.5 index point in mid-Apr24). In accordance, we revise our Rupiah expectation to Rp15.8k/US$ yearly average from Rp15.1k/US$ previously (Rp15.2k/US$ in FY23).

Sumber : IPS

powered by: IPOTNEWS.COM